Tuesday, June 12, 2007

Mysteriöser Fall: Wo ist Bushs Armbanduhr?

Saturday, May 05, 2007

What is Service Oriented Architecture? SOA

Meet the architects

What is Service Oriented Architecture? SOA

SOA in the Publising Industry

SOA in Auto Industry - Volvo

Thursday, May 03, 2007

METRO Group steigert Umsatz im ersten Quartal um 12,1 Prozent

METRO Group steigert Umsatz im ersten Quartal um 12,1 Prozent

Die METRO Group ist dynamisch in das Jahr 2007 gestartet. Im ersten Quartal steigerte das Unternehmen seinen Gesamtumsatz im Vergleich zum Vorjahreszeitraum um 12,1 Prozent auf 14,9 Mrd. €. Auch nach Herausrechnung der 2006 erfolgten Akquisitionen von Wal-Mart Deutschland und Géant Polen stieg der Umsatz deutlich um 7,8 Prozent.

"Die Umsatzentwicklung im ersten Quartal unterstreicht unseren nachhaltigen Erfolgskurs. Die METRO Group hat ein starkes Fundament für ein erfolgreiches Geschäftsjahr 2007 gelegt," sagte Dr. Hans-Joachim Körber, Vorstandsvorsitzender der METRO Group. "In allen Regionen konnten wir deutlich zulegen. Besonders erfolgreich waren wir abermals in unseren Wachstumsregionen Asien und Osteuropa. Aber auch in den herausfordernden Märkten Westeuropas und in Deutschland entwickelten sich unsere Geschäfte positiv – obwohl die allgemeine Konsumstimmung in Deutschland zu Beginn des Jahres von der Erhöhung der Mehrwertsteuer belastet wurde."

In Westeuropa stieg der Umsatz in einem weiterhin sehr wettbewerbsintensiven Umfeld um 7,8 Prozent. In Osteuropa hat die METRO Group ihren dynamischen Wachstumskurs fortgesetzt. Zu der deutlichen Umsatzsteigerung von 22,6 Prozent trugen alle dort vertretenen Vertriebslinien bei. In Asien und Afrika wuchs der Umsatz sogar um 24,9 Prozent. Der internationale Anteil am Umsatz erhöhte sich trotz der Akquisition von Wal-Mart Deutschland von 54,8 Prozent im Vorjahreszeitraum auf 55,8 Prozent.

In Deutschland lag der Umsatz trotz der Mehrwertsteuererhöhung um 9,7 Prozent über dem Vorjahresquartal. Auch ohne die erworbenen Wal-Mart Standorte stieg der Umsatz im Inland, und zwar um 2,1 Prozent. Besonders im März entwickelte sich das Geschäft positiv.

Das Ergebnis vor Zinsen, Steuern und Abschreibungen (EBITDA) der METRO Group stieg um 2,8 Prozent auf 434 Mio. €. Das EBIT lag bei 123 Mio. €, nach 138 Mio. € im Vorjahresquartal. Wie erwartet sind im Ergebnis temporäre Belastungen von rund 15 Mio. € enthalten, die aus der Integration der im Jahr 2006 bei Real getätigten Akquisitionen resultieren. Bereinigt um diese Aufwendungen lag das EBIT auf Vorjahresniveau. Das Ergebnis je Aktie (EPS) betrug -0,03 €, nach 0,02 € im ersten Quartal 2006.

Die METRO Group betrieb zum 31. März 2007 insgesamt 2.388 Standorte in 30 Ländern. Im ersten Quartal wurden 15 Märkte neu eröffnet, zehn davon durch Media Markt und Saturn.

Metro Cash & Carry mit deutlicher Ergebnissteigerung

Metro Cash & Carry hat im ersten Quartal 2007 trotz einer hohen Vorjahresbasis den Umsatz um 5,1 Prozent auf 7,0 Mrd. € gesteigert. Bereinigt um Wechselkurseffekte lag das Wachstum bei 5,6 Prozent. Der Auslandsanteil der Vertriebslinie stieg weiter auf 81,5 Prozent.

Besonders starke Zuwächse wurden abermals in Osteuropa und Asien erzielt. Auf diese Wachstumsregionen entfällt mittlerweile weit mehr als ein Drittel des Umsatzes der Vertriebslinie. In Osteuropa erwirtschaftete Metro Cash & Carry ein Plus von 12,3 Prozent. In Asien und Afrika nahm der Umsatz um 15,7 Prozent zu. Sehr positiv verlief das Geschäft weiterhin in China. In Westeuropa stieg der Umsatz um 0,6 Prozent, in Deutschland sank er leicht um 0,4 Prozent.

Das EBIT von Metro Cash & Carry verbesserte sich deutlich, und zwar um 12,8 Prozent auf 102 Mio. €. Das Vertriebsnetz wurde um einen Standort in China erweitert. Damit betreibt Metro Cash & Carry dort mittlerweile 34 Großmärkte. In diesem Jahr sollen insgesamt rund 40 neue Großmärkte eröffnet werden. Metro Cash & Carry war zum Ende des ersten Quartals an 585 Standorten in 28 Ländern vertreten.

Real in Deutschland mit flächenbereinigtem Umsatzwachstum

Der Umsatz der Vertriebslinie Real stieg um 29,1 Prozent auf 3,0 Mrd. €. Davon entfielen 578 Mio. € auf die übernommenen SB-Warenhäuser von Wal-Mart in Deutschland und Géant in Polen. Bereinigt lag der Umsatzzuwachs bei 4,2 Prozent. Real hat damit den positiven Trend des Jahres 2006 fortgesetzt.

Besonders erfolgreich war Real weiterhin im Ausland mit einem Umsatzwachstum von 81,9 Prozent. Auch ohne Géant in Polen steigerte Real in Polen, Rumänien, Russland und der Türkei deutlich seine Umsätze, und zwar um 35,1 Prozent. Alle 19 übernommenen Géant-Märkte wurden im ersten Quartal planmäßig auf Real umgestellt. Der internationale Umsatzanteil stieg von 11,3 auf 15,9 Prozent.

Auch in Deutschland verbuchte Real ein flächenbereinigtes Umsatzwachstum. Trotz der zeitweiligen Schließung von Real SB-Warenhäusern im Zuge der Konzeptumstellung stieg der Umsatz auf gleicher Fläche um 1,1 Prozent. Zum Quartalsende zählten zum Standortnetz 15 Konzeptmärkte sowie 33 ehemalige Wal-Mart-Märkte, die bereits auf Real umgestellt wurden. Diese Märkte zeigten im ersten Quartal insgesamt eine überdurchschnittliche Entwicklung.

Im Ergebnis spiegeln sich die Aufwendungen für die Integration der 2006 getätigten Akquisitionen wider. Das EBIT betrug -56 Mio. €, nach -40 Mio. € im Vorjahresquartal. Nach Herausrechnung der Integrationskosten von rund 15 Mio. € erreichte Real im ersten Quartal 2007 ein Ergebnis auf Vorjahresniveau. Darüber hinaus enthält das Ergebnis gestiegene Belastungen aus der forcierten internationalen Expansion in Osteuropa.

Das Vertriebsnetz umfasste zum Ende des Quartals 700 Standorte, davon 627 in Deutschland und 73 im Ausland.

Ausblick

Die METRO Group wird auch im weiteren Verlauf des Geschäftsjahres 2007 ihren Weg des profitablen Wachstums fortsetzen. Die internationale Expansion wird konsequent vorangetrieben, wobei der Schwerpunkt weiterhin auf den Wachstumsmärkten in Osteuropa und Asien liegen wird.

Vor dem Hintergrund der guten Entwicklung im ersten Quartal rechnet die METRO Group für das laufende Geschäftsjahr weiterhin mit einem Umsatzanstieg von 8 bis 9 Prozent, inklusive der 2006 getätigten Akquisitionen. Darüber hinaus wird ein EBIT-Anstieg von 6 bis 8 Prozent angestrebt (Basis 1,91 Mrd. €). Das Investitionsvolumen der METRO Group wird im laufenden Geschäftsjahr voraussichtlich rund 2,5 Mrd. € erreichen. Die Mittel werden vor allem für die fortgesetzte internationale Expansion der Wachstumstreiber Metro Cash & Carry sowie Media Markt und Saturn aufgewandt. Darüber hinaus investiert die METRO Group in die Umstellung der ehemaligen Wal-Mart-Märkte auf das Real-Konzept und die selektive Expansion von Real in Osteuropa.

Quartalsfinanzbericht Q1 2007 pdf (183 KB)

Veröffentlichungsdatum: 04.05.2007

Copyright © fruchtportal.de

Monday, April 16, 2007

China: Germany - The EU Favorite For Chinese Investors - Part I

China: Germany - The EU Favorite For Chinese Investors - Part I

16 April 2007

Originally published December 2006

By Thomas Busching and Stefan Peters in Squire Sanders’ Frankfurt office.

According to a recent survey of top executives from the largest Chinese companies, Germany is the number one destination for Chinese companies establishing operations in Europe. The reason: favorable conditions that suit international first-timers. The main factors cited by the 96 respondents were Germany’s cost of operations, legal infrastructure and tax system. According to the survey, Chinese companies seek to establish European operations mainly to find new markets for Chinese goods and acquire new management as well as technology.

The choice of Germany for Chinese companies seems to make sense. The largest market within the European Union, Germany is highly regarded for its technology in the automotive, aerospace, logistics, pharmaceutical and chemical, machinery and mechanical engineering industries. Beyond those traditional industries, Germany leads the field in several new industries such as renewable energies, medical technology and optoelectronics, as well as nano- and biotechnology. Also, as one of the leading export nations, Germany has managers who are well-versed in trade at the international level. In essence, by establishing operations in Germany, Chinese investors can kill three birds with one stone.

The fastest and, in most instances, most costefficient way of entering a new market is by acquiring a local company with an established brand, distribution channels, technology, management, know-how and know-who. When entering the market via an acquisition, an investor will be in a much clearer position to calculate the costs of entering the market and to immediately see what he is receiving for his investment – which may be different with greenfield investments, in which unpleasant surprises and uncertain returns are more likely than not.

Given these basics, the standard M&A procedure for a Chinese company investing in Germany involves several steps. Here, we provide a brief overview of the main legal and tax parameters for German investment by a Chinese investor, starting with the approvals required by China.

1. Chinese Approval Procedures

Generally, cross-border investments by Chinese corporations and individuals are subject to government approvals. The legal effectiveness of key transaction contracts executed by Chinese investors, and the ability of these investors to complete various procedures and formalities relating to foreign exchange controls, tax matters, customs regulations and other matters necessary for an investment offshore, are usually subject to governmental approvals or, at least, to application for such approvals. The authority to approve overseas investments in nonfinancial sector businesses is shared between the State Development and Reform Commission (SDRC) or the State Council, depending on the size and nature of the specific investment, and the Ministry of Commerce (MOFCOM). The SDRC or the State Council approves policy-related aspects of overseas investments, while MOFCOM reviews and approves transaction documents related to investments.

Additionally, overseas investments must comply with registration and approval requirements imposed by the State Asset Supervisory and Administration Commission (SASAC), if the Chinese investor holds state-owned assets.

However, the main obstacle for Chinese overseas investments is China’s currency system. All PRC investors investing in or acquiring overseas companies must go through the process of foreign exchange-related examinations and registrations with the State Administration on Foreign Exchange (SAFE) or its local equivalent. A PRC investor is not able to remit foreign exchange out of China until it has completed the necessary SAFE examinations and registrations. SAFE slightly relaxed its regulations in 2006, specifically with regard to payment of preliminary costs for an overseas investment to be remitted out of China, but SAFE approval is still one of the biggest concerns related to Chinese overseas investments.

Once Chinese domestic issues surrounding a Chinese investment in Germany have been addressed, the Chinese investor can focus on the German issues.

2. Mergers and Acquisitions in Germany

In principle, the process of an acquisition in Germany structured in the form of a share deal does not differ very much from the M&A process in China. The procedure may be summarized as follows:

Please note that the standard procedures may need to be adjusted to the specific deal structure and legal status of the target (e.g., in an asset deal; under bidding, antitrust, impending or ongoing insolvency conditions; for listed companies, partnerships, etc.).

3. The General Investment Environment in Germany

With no foreign ownership restrictions, Germany provides very favorable conditions for foreign investments. Chinese investors may invest in any industry and own the whole business if they wish. This is equally true for the purchase of freehold real estate property. Capital and profits may be moved freely across borders. There are no currency restrictions, and the euro floats freely with all other currencies. In most cases, business licenses are either not required or are readily obtained – and have already been approved if an existing company is acquired.

One of the most common corporate forms used by German businesses is that of a "GmbH," described below.

4. The GmbH

A. Nature of a GmbH

A GmbH is a limited liability company used for small businesses, medium-sized family businesses or even large businesses. An incorporated entity with its own legal personality, it can be established for any lawful purpose. Its share capital is determined in its Articles of Association and corresponds with the sum of its shareholders’ capital contributions.

Only the company is liable to creditors for debts incurred by the company.

A GmbH is the simplest and least expensive form of corporate entity available in Germany. The particular advantage of a GmbH is its flexibility. As with a corporate entity in China, the Memorandum and Articles can be drafted in many different and flexible ways. A GmbH is subject to less severe regulations than a public limited company (AG); its formation is less formal and is, therefore, simpler and less costly.

In the case of small GmbHs, a supervisory board is not required. There are no restrictions on the sale of shares other than the need to have their transfer notarized by a notary public. However, the Articles may make the sale and transfer of shares dependent on other requirements; for example, they may be dependent upon the approval of the other shareholders.

B. Main Features

The GmbH is a capital-based company; unlike a partnership, the main feature is not an agreement to work together, but the assembly of capital contributions. However, it is a more personal form of entity than a public limited company (AG). The minimum capital required is €25,000.

A GmbH is a separate legal entity from its shareholders. It has its own organization, objectives and corporate bodies. The activities of a GmbH are determined by its Articles of Association, director or directors and its general meeting of shareholders. The directors are required to adhere to the instructions of the shareholders. A supervisory board may be appointed, but such a board is necessary only for larger GmbHs. Shareholders are not personally liable to creditors once their capital contributions have been paid to the company in full.

C. Shareholders of a GmbH

There is no requirement that a GmbH have a minimum or maximum number of shareholders. It is even possible for only one person to form a GmbH. Additionally, the citizenship of the shareholders is not restricted. They may be either individuals or legal entities, domestic or nondomestic.

The company’s name may be freely chosen, so long as it is not misleading or in conflict with existing companies’ names. The abbreviation "GmbH" must be added to the company’s name.

D. Formal and Publicity Requirements

The initial Articles of a GmbH must be certified by a notary, and every subsequent amendment or adjustment must also be certified. The Articles must include the following particulars: company name, registered office, object of business, amount of share capital and amount payable by each shareholder to the share capital. Otherwise, flexibility is permitted in drafting the Articles.

However, it is advisable to include information covering the following areas in the Memorandum and Articles: duration of the company; rules for appointment of managers; the extent of the representative powers of managers; rules for the convocation of a general meeting; rules for allocation of votes; rules for disposals of shares and inheritance of shares; rules for production of annual accounts, allocation of profits, repurchase of shareholdings, disposal of shares and disputes; rules on formation costs; an exemption from the ban on managers contracting with themselves; and arbitration and noncompetition clauses.

Upon notarization of the Articles, the shareholders must produce valid identification documents to prove their identities. If the person appearing is an agent for someone else, the agent must have a formal written power of attorney, or his or her actions must be certified retrospectively in notarially certified form. If a notary outside Germany is performing the certification, a legalization is required. This can be obtained from a German consulate or embassy. If the founders include a legal entity, the existence of this corporate entity must be proven in the form of a certified extract from the commercial register (or the equivalent official registration documents, such as, in the case of non-German entities, certificates of incorporation).

Thursday, April 12, 2007

U.S. and Global Third-Party Logistics (3PL) Market Analysis Is Released

U.S. and Global Third-Party Logistics (3PL) Market Analysis Is Released

STOUGHTON, Wis., April 12 /PRNewswire/ -- Third-party logistics gross

revenues for the U.S. broke $110 billion for the first time in 2006. 3PL

gross revenues hit $113.6 billion, a 9.5% increase. Net revenues were $53.1

billion. EBIT and net income margins in relation to net revenue were 8.6%

and 5.4% respectively. Margins for the year were down slightly due to the

fourth quarter economic slowdown.

As part of its just released report, Armstrong & Associates estimates

the global third-party logistics market at $391 billion. European 3PL

revenues are estimated at $139 billion.

For the U.S. market, International Transportation Management (ITM),

which includes major components of freight forwarding and global supply

chain management, had net revenue increases of 17.7%. Kuehne + Nagel,

Expeditors, DHL Global and APL all had net income margins of 10% or greater

compared to net revenue. ITM growth is primarily a reflection of continued

economic expansion in China and the Asia Pacific markets.

Domestic Transportation Management (DTM), including freight brokerage,

posted a 12% gain in net revenues (gross margin). Gross revenues (turnover)

were $33.8 billion. BAX, BNSF, C.H. Robinson, Meridian IQ and NFI grew by

more than 20%. Hub, Penske, Ryder and Werner grew by 10% or more. After-tax

Net margin for DTM was 11.1%

DTM net revenue growth slipped from 18% in 2005 and net income margin

dropped by 1%. We attribute these changes to the U.S. economic slowdown;

they are temporary downturns and have no significant long term importance

for key players in DTM. Despite the slowdown, C.H. Robinson still ended the

year with net revenues of $1.1 billion and a net income margin of 24.7%.

BNSF Logistics, Hub, NFI and Werner all had double digit net income

margins.

Table 1. Revenues and Profitability by 3PL Segment -- 2006

Turnover

(Gross Net Net Net Income

Revenue) Revenue Revenue (Profit)

3PL Segment $ Billions $ Billions Growth Margin

Domestic

Transportation

Management 33.8 6.6 12.0% 11.1%

International

Transportation

Management 42.4 15.9 17.7% 5.7%

Dedicated Contract

Carriage 11.0 10.9 8.0% 4.4%

Value-Added

Warehouse/Distribution 23.4 19.7 9.7% 3.9%

Total (1) 110.6 53.1 11.9% 5.4%

(1) Total turnover (gross revenue) for the 3PL industry in the U.S. is

estimated at $113.6 billion; $3 billion is included for the contract

logistics software segment.

The complete report can be obtained online at:

http://www.3plogistics.com/shopsite/index.html. Armstrong & Associates'

Extended Information Service subscribers will receive the report this week.

About Armstrong & Associates: Armstrong & Associates, Inc. is a supply

chain management consulting firm specializing in market research, mergers

and acquisitions and outsourcing. Armstrong & Associates publishes Who's

Who In Logistics? Armstrong's Guide to Global Supply Chain Management.

Recent research papers include An Overview of Warehousing in North America

-- 2007 Market Size, Major 3PLs, Benchmarking Prices and Practices and

Brand Recognition, RFP Activity and Expected Profit Margins for 3PLs --

2007. In addition, Armstrong & Associates maintains databases of

warehousemen, freight forwarders and third-party logistics and distributing

companies.

SOURCE Armstrong & Associates

Monday, April 09, 2007

How to Remain Lean in Logistics

How to Remain Lean in Logistics

By T. D. Clark

In order to avoid the average 7.96 percent increase in logistics costs that the average process industry company has been hit with over the past two years, a new Aberdeen Group report suggests aping the ways of Best in Class companies.

The new Aberdeen Group report "Supply Chain Cost-Cutting Strategies: How Top Process Industry Performers Take Radically Different Actions” involved 74 process industry companies including those in the chemicals, pharmaceuticals, food and beverage, oil and gas, and pulp and paper sectors.

“Although three-quarters of all process industry companies are focusing on supply chain transformation, we found that Best in Class companies are strikingly ahead of their peers in achieving their transformation goals,” says Beth Enslow, Aberdeen SVP of Enterprise Research and author of the report. “They are four times more likely than their lower-performing peers to have established a centralized supply chain management organization and to have achieved data and process visibility across their supply chain, enabled by their higher adoption rate of technology.”

Other key highlights from the study:

• Best in Class companies have a 2.5x to 9x advantage in key performance improvements, including advancements over the past two years in the following:

o Forecast accuracy,

o Perfect order percentages and

o Manufacturing and logistics costs.

• Best in Class companies are twice as likely to have the following:

o Logistics costs as a percentage of sales of 6 percent or less,

o A perfect order percentage of 91 percent or better, and

o A product family-level forecast accuracy of 71 percent or better.

What does it mean to be “Best in Class” in logistics?

Well, if you’re the Defense Logistics Agency (DLA), it means forking over some $250 million to Accenture to provide business systems integration, systems engineering and application management services. Under a new contract, Accenture will work with DLA to deliver new capabilities that focus on providing more efficient, effective and reliable supply-chain support to the military services and America’s warfighters, according to the recent announcement. Accenture will continue to modernize DLA’s multiple logistics systems into a single, integrated end-to-end system, extending business functions based on leading practices and replacing legacy software systems with commercial-off-the-shelf (COTS) software.

While “a single, integrated end-to-end system” is a phrase that has more than likely worn out its welcome, it makes perfect sense when applied directly to logistics where deep visibility is critical. Maybe that’s why everyone was so excited about the potential of radio frequency identification (RFID). Heck, some of us are still excited by RFID’s possibilities and its role in logistics.

Take a recent Forbes piece entitled “RFID and the Search for Perfect Logistics”, for instance. Penned by AMR Research analyst John Fontanella, the first passage speaks volumes:

While working with a client to define specifications for a new warehouse management system, a member of the manufacturing team, new to the world of distribution, asked us a simple but thought-provoking question: "Why don't logistics processes perform at the same high-quality standards that my production lines do?"

Fontanella argues that a wide range of literacy skills, job aptitudes and experience in the workforce prevents the consistency needed to operate at very high levels of performance. “Manufacturing learned this lesson long ago, having spent the last 20 years automating its assembly lines and, in the process, stretching performance to what was before unimaginable levels,” according to Fontanella who claims that there is no reason why logistics should lag.

RFID, in combination with other technologies, can provide the quantum leaps needed in execution performance, says Fontanella. But for this to become a reality, the right combination of companies need to come together to form a scalable, replicable and cost-effective RFID/logistics strategy — something that still hasn’t happened yet.

If the right RFID solution existed, would your company consider investing in it to enable a leaner logistics operation?

Check back in with the blog tomorrow for the latest issue of the IMT newsletter, in which we further delve into how Lean can be applied throughout the entire supply chain.

Tuesday, April 03, 2007

Wednesday, February 28, 2007

沃尔玛收购部分中国好又多股份

Wal-Mart buying up big in China

WITH growth slowing at its outlets in the US and its stock price slumping, Wal-Mart Stores is aiming to gain greater access to the world's most rapidly growing major economy by buying into one of China's biggest retailers.

Wal-Mart said on Tuesday its purchase of a 35 per cent stake in the Bounteous Co., a Taiwan-owned group that operates more than 100 retail outlets in China, was part of a strategy to expand in large emerging markets such as Brazil and India, as well as China.

Wal-Mart declined to say how much it paid to buy a piece of Bounteous, but people close to the deal said Wal-Mart had agreed to pay close to $US1 billion ($1.3 billion) to assume control of the Chinese retailer.

China has a fast-growing middle class that may now number close to 50 million. But China's market is fragmented, and so far it has no dominant national retail chain such as Wal-Mart.

Bounteous, which operates in 34 cities in China under the name Trust-Mart, will continue to operate independently for now.

But eventually, Wal-Mart is expected to take control of Trust-Mart. Wal-Mart, the world's largest retailer, operates 73 stores in China and has more than 37,000 employees here. Trust-Mart has more than 31,000 employees in China.

If Wal-Mart takes control of Bounteous, it would move into position to become the country's dominant foreign retailer. But it faces stiff competition from other large Chinese retailers, as well as European retail rivals such as Carrefour of France, Metro of Germany and Tesco of Britain.

"This is an important step in bringing additional scale to our China retail business," Michael Duke, the vice chairman of Wal-Mart, said in a statement.

By acquiring a stake in Trust-Mart from Bounteous, which is privately held, Wal-Mart could surpass Carrefour, which has about 90 superstores operating here and had $US2.3 billion in sales in 2005.

But Wal-Mart's profits here are unlikely to contribute significantly to the company's earnings over the next few years.

Before the deal, Wal-Mart's China operations accounted for only a tiny fraction of its global sales, which were more than $US344 billion last year. In 2005, the most recent year with figures available, Wal-Mart had sales of about $US1.3 billion in China, trailing Trust-Mart, which had sales of $US1.7 billion, according to the China Chain Store and Franchise Association.

In order to manage integration of the two operations, Wal-Mart said it would appoint one of its executives as chief operating officer of Trust-Mart stores.

The Chinese Government also recently made it easier for foreign retailers to set up operations here. Home Depot and Best Buy are opening branches in China, and dozens of other American and European retailers are also planning to move in.

Analysts say Wal-Mart, which first entered the Chinese market in 1996, is trying to create a broader presence in China, which could mean many more acquisitions.

"From Wal-Mart's perspective, it's a foot in the door," said George Svinos, the chief of Asia Pacific retail for the accounting firm KPMG in Australia. "You can clearly see why Wal-Mart is looking to invest in a country that by 2015 could have the largest economy in the world."

With the deal, Wal-Mart is also trying to get back on track after the company stumbled in South Korea and Germany; it sold its operations in those countries last year.

The market in China is tough as well. Prices are extremely low, and infrastructure problems continue outside of the biggest cities. The market is fast evolving and sometimes unpredictable.

Wal-Mart now has to cope with China's state-controlled unions, which are pushing their way into foreign-owned companies and retail operations.

Last year Wal-Mart agreed to allow unions to be set up in nearly all of its stores in China. And while unions in China are controlled by the state-run union federation and often lack bite, some analysts say they could be gaining influence here, and may begin bargaining for higher wages and better compensation packages.

China is also Wal-Mart's huge procurement centre. Last year more than $US9 billion worth of goods from here went to Wal-Mart stores operating outside of China, so Wal-Mart plans to be a presence here in both procurement and retailing.

The New York Times

Wednesday, February 21, 2007

究竟什么是“玫瑰星期一“?

Was ist eigentlich ... der Rosenmontag?

Der Rosenmontag ist der Tag, an dem die traditionellen Karnevalsumzüge stattfinden. Der erste organisierte Rosenmontagsumzug fand 1824 in Köln statt.

Heute ziehen in allen rheinisch geprägten Karnevalsgegenden mehr oder weniger große Umzüge durch die Orte, die aus reich geschmückten Motivwagen mit politischen, sportlichen oder sonstigen Anspielungen, sowie aus buntkostümierten Fußgruppen und Musikkapellen bestehen. Die größten Umzüge finden in den Karnevals- oder Fasnachtshochburgen Köln, Mainz und Düsseldorf statt.

Narrensprung

Im schwäbisch-alemannischen Raum regiert am Rosenmontag der sogenannte Narrensprung. Hierbei ziehen maskierte und zum Teil Furcht erregend aussehende Gestalten durch die Straßen, bewegen sich zum Rhythmus des Narrenmarsches und erschrecken Passanten. Dabei produzieren sie mit Rollen, Schellen, Peitschen und anderen Geräten einen Höllenlärm. Am größten und bekanntesten ist der Rottweiler Narrensprung.

Rasender Montag

Zur Entstehung des Namens Rosenmontag gibt es verschiedene Theorien: Eine besagt, dass die Bezeichnung nichts mit den Blumen zu tun habe, sondern sich vom Verb 'rasen' ableite, was so viel heißt wie 'lustig sein', 'toben', 'sich toll gebärden'.

Rosensonntag

Eine andere Erklärung begründet sich in der Fastnachtsreform des 19. Jahrhunderts: 1823 wurde in Köln das 'Festordnende Komitee' gegründet, das als Ziel hatte, den Karneval geordnet ablaufen zu lassen. Dieses Komitee hielt jeweils am Montag nach dem dritten Sonntag 'Laetare' seine Generalversammlung ab. Dieser Sonntag hieß seit dem 11. Jahrhundert auch Rosensonntag, weil der Papst an diesem Tag eine goldene Rose weihte und einer verdienten Persönlichkeit überreichte. Das Komitee, das den Fastnachtsumzug am folgenden Montag organisierte, nannte sich daher einfach 'Rosenmontagsgesellschaft', wobei sich wahrscheinlich der Name zunächst auf den Umzug und schließlich auf den gesamten Tag übertrug.

Hungrige Engel

In der Rheingegend ließ man früher am Abend des Rosenmontag die Fenster offen, damit sich die Engel etwas von den Mahlzeiten holen konnten. Man war der Überzeugung, dass die Fastenzeit im Himmel besonders streng eingehalten würde und wollte somit den Engeln Gelegenheit geben, sich noch einmal richtig satt zu essen. Besonders die Kinder warteten gespannt auf das Flügelrauschen.

Tuesday, February 20, 2007

DPWN's DHL unit to expand logistics capacities to 300,000 square metres

02.19.07, 9:50 AM ET

BONN/DUBAI (AFX) - Deutsche Post World Net AG's DHL unit will expand its logistics capacities in Dubai to 300,000 square metres from 85,0000 in the coming years, chief executive Klaus Zumwinkel said on Sunday in Dubai.

He added that this will enable the company to meet demand in the Middle East which 'has an impressive growth potential and offers great perspectives to Deutsche Post World Net'.

Comprising an area of 140 square kilometres, Dubai World Central will be the largest airport and first fully-integrated logistics platform in the world, he said.

Monday, February 19, 2007

与小猪在一起!---中国开始了非同寻常的一年

Wang Wei hat Glück. Und er weiß auch genau, wie es aussieht: rund und rosig, mit ein paar schüchternen schwarzen Haaren und einem winzigkleinen Kringelchen. Und natürlich sieht es ihm ähnlich. Ein Schweinchen, ganz eindeutig. Sie haben sehr lange darauf gewartet, Wang Wei, der Architekt, und Liu Xiaoyu, seine Frau. Im Mai, endlich, werden sie ein Kind bekommen. Es wird ein Sohn, das wissen sie schon. Vor einem Jahr überraschte mich Wang, als ich ihn nach seiner Familie fragte.

"Nein, wir haben noch kein Kind, wir warten noch." Worauf? Beide arbeiten und verdienen gut. Wang hat in Europa studiert und gearbeitet, ist Büroleiter bei einer internationalen Firma in Shanghai, ein fähiger Mann in seinem Beruf, fleißig und ein begabter Organisator. Warum warten? Das schien so unchinesisch zu sein. "Wissen Sie", hatte er schmunzelnd erklärt, "ich bin jetzt 35 Jahre alt, im gleichen Alter wie meine Frau. Wir warten bis 2007." Er kicherte. "Ich bin im Zeichen des Schweins geboren und meine Frau auch. Darum soll unser Kind ebenfalls ein Schweinchen werden."

Zweiter Neumond

Jetzt beginnt das Jahr des Schweins, am 18. Februar 2007. Alle Chinesen auf der Welt richten sich nach dem traditionellen Mondkalender. Der legt Neujahr auf den Beginn des zweiten Neumonds nach der Wintersonnenwende, in jedem Jahr also zu einem anderen Datum. Zwölf Tiere symbolisieren die Jahre, die Chinesen sprechen ihnen ganz verschiedene Bedeutung und Eigenschaften zu. Für alle steht fest: Das Schwein bringt Glück. Es trippelt mit seinen kurzen Beinen zwar erst am Schluss der Zwölferreihe, aber es ist besonders beliebt.

Wer im Zeichen dieses gemütlichen Tieres geboren ist, den umgibt die Aura des Glücklichen. Glück wird also auch dem kleinen Wang in die Wiege gelegt. Er wird als ehrlich gelten, als tapfer, galant und großzügig. Er hat zweifellos ein reines Herz und starke Gefühle. Und er ist mit einem großen Appetit gesegnet.

Große Erwartungen

Erst 2019 gibt es wieder ein Schweinejahr. Da richten sich große Erwartungen an die verheirateten Frauen. Sie werden, vor allem von der Schwiegermutter, für alles verantwortlich gemacht, was in der Ehe nicht wunsch- und traditionsgemäß verläuft: Schwangerschaft oder nicht, Geburt eines der weniger gewünschten Mädchen, und jetzt, wenn es kein Schweinchen wird.

Die Shanghaier Edel-Klinik "Xiyue" ist fast ausgebucht. Hier sollen die vielen Glücksschweinchen in die chinesische Welt gebracht werden, standesgemäß, nicht etwa in einem Schweinekoben. In Shanghai ist es modern, mehr als ein Kind zu haben. In der 22-Millionen-Stadt garantiert nicht mehr nur das ausländische Auto oder ein protziges Apartment das größte Ansehen bei Nachbarn und Freunden. Wer mit zwei Kindern auftritt, statt nur mit dem einen staatlich erlaubten, kann sich des Respekts sicher sein. Denn damit führt der doppelte Vater der ganzen Welt vor, dass er nicht nur die staatliche Strafe von mindestens 6000 Euro zahlen kann, sondern flüssig genug ist, zwei Kinder großzuziehen. Denn das ist sündhaft teuer in China.

Richtiges Ambiente

"Xiyue", übersetzt "Besiegeltes Glück", bietet der Mutter und ihrem Kleinen das richtige Ambiente für die Geburt. Es ist nicht nur ein Quartier für die Wehen. Das erst vor ein paar Monaten eröffnete Anwesen zeigt sich strahlend wie eine Mischung aus Kaiserpalast und Hollywood-Kulisse. Die Bettbezüge in Rot und Gold, die Möbel in den großen Suiten aus Kirschbaumholz. Natürlich mit Golfplatz, Tennis-Court, Swimming-Pool und aufmerksamem Personal. Mit Yoga-Club und Karaoke-Bar, wohl eher für den besuchenden Ehemann und neuen Vater. 4000 Euro im Monat für ein einfaches Zimmer. Für die zweigeschossige Wohnung muss man eintausend Euro pro Tag an der Kasse abgeben.

Nach der Geburt verlangt die chinesische Tradition eine lange Ruhephase von der Mutter. Sie und das Neugeborene seien dann besonders anfällig für den Einfluss böser Geister, daher sollten sie sich besser verstecken. Diese Wochen heißen auf Chinesisch "Yuezi". Das könnte durchaus mit "Gefangenschaft" übersetzt werden, befände die strapazierte Mutter sich nicht in dieser einzigartigen Geburtsklinik. "Xiyue" macht die sonst tristen Tage zu einem wohligen Urlaub, mit einem "postnatalen Wellness-Angebot" und mit Schwimmkursen für Chinas neuste Bürger.

Goldenes Schwein

In den anderen Hospitälern sieht es anders aus, gerade jetzt. Denn China erwartet im neuen Mondjahr sozusagen eine große Schweinerei. Die Geburtenrate - so erwarten Ärzte und chinesische Traditionalisten - dürfte drastisch steigen, alle wollen kleine Schweinchen. In Peking wird mit 150.000 Neugeborenen gerechnet, sechzehn Prozent mehr als 2006. Denn diesmal werden es nicht einfach nur schlichte Glücks-Tierchen, simple rosa Borstentiere, dieses Jahr zählt für viele Chinesen als "jin zhu"-Jahr, als Jahr des Goldenen Schweins. Das wird als höchstes Glück angesehen, das gibt es nur alle sechzig Jahre.

Wer dann geboren wird, hat mächtig viel Schwein und könnte Milliardär werden oder Generalsekretär der Partei oder Fußball-Held. Über weibliche Schweinchen wird viel weniger nachgedacht in China. Durchschnittlich werden 118 Jungen geboren, im Verhältnis zu 100 Mädchen. Auf dem Land und vor allem im Süden sind es 130 zu 100, in manchen Gegenden und ausgerechnet unter hohen Funktionären gar 230 Jungen und nur 100 Mädchen.

Hunde-Ehe und Schweine-Segen

Das letzte Mondjahr, das Jahr des Hundes, machte seinem Ruf als gutes Hochzeitsjahr alle Ehre. In Peking wurde soviel geheiratet wie seit zwanzig Jahren nicht mehr. Klar doch, die Hunde-Ehe führt zu Schweine-Segen. In einigen Krankenhäusern Shanghais liegen schon sechs werdende Mütter in Vierbettzimmern. In Peking appellierten Mediziner und Behörden an die zukünftigen Schweinchen-Eltern, nicht nur in die renommierten Geburts-Kliniken zu drängen. In den 170 Spezial-Hospitälern gibt es 3800 Betten und 3000 Ärzte und Schwestern.

Der Schweinchen-Aufgalopp bringt die staatliche Planung aber nur vorübergehend durcheinander. Denn "yinger chao", die Babyschwemme, macht sich nur als Verschiebung eines Höhepunkts innerhalb der Statistik bemerkbar, wahrscheinlich nicht in der Summe der Neubürger. Die Schwangerschaft wird einfach auf dieses Jahr hin geplant, meist auf den Druck der zukünftigen Großeltern hin. Der letzte Gipfel in der Geburtenrate bildete sich im Jahr 2000. Das war das Jahr des Drachen, er gilt als der Ur-Ahn aller Chinesen, ein besseres Tierkreiszeichen gibt es nicht.

Das größte aller Feste

Das Neujahr-Frühlingsfest ist für alle Chinesen das größte und schönste aller Feste. Etwa so wie Geburtstag, Weihnachten, Ostern und der Kalender-Jahreswechsel auf einmal. Die Tradition will, dass sich dann die Familien unter dem Dach des Vaterhauses treffen. Alljährlich findet daher zum Winterende die größte moderne Völkerwanderung statt, in China und auch bei den Auslandschinesen.

In einem Zeitraum von vierzig Tagen machen sich Milliarden über die Transportmittel her. 2,17 Milliarden Reisen werden in dem Fest-Zeitraum von 40 Tagen absolviert. Die Eisenbahn befördert diesmal 156 Millionen Passagiere. 1,97 Milliarden Busreisen sind gebucht, neunzig Prozent aller Touren. Schiffe, Flugzeuge und Autos bersten, denn Geschenke müssen mitgebracht werden, nicht nur die kleinen roten Umschläge mit Geld für die Kinder.

Chinas 200 Millionen Wanderarbeiter bleiben in einem Jahr nur elf Monate an ihrem Arbeitsplatz; sie beginnen nach Neujahr und machen sich vor dem nächsten Neujahr wieder nach Hause auf.

Last der Leckerbissen

In der Nacht vor Neujahr wird gefeiert, gespielt, gesungen, ferngesehen und gegessen. Die Tische müssen sich unter der Last der Leckerbissen biegen, sonst runzeln die Ahnen enttäuscht die Stirn. Die Familien bereiten gemeinsam Jiaozi, die traditionellen Teigtaschen mit vielen verschiedenen Füllungen. Papiergeld wird verbrannt, damit es den Vorfahren im Jenseits an nichts mangelt. Um Mitternacht zischen Leuchtraketen in den Himmel, lauter Böllerknall soll die bösen Geister vertreiben. Etwa eine Woche vorher und eine Woche danach ruht das offizielle China. Nichts geschieht, außer das Wetter. Und das ist am Neujahrstag in Peking fast immer kalt aber sonnig.

Wang Wei hält den roten Gürtel bereit, der ihn im neuen Mondjahr als einen der Ausgewählten ausweisen soll. Sogar Minister und Geschäftsleute tragen, wenn ihr Tierkreiszeichen das Jahr prägt, gern ein kleines rotes Bändchen am Gürtel oder am Jackett. Diesmal strahlen und strotzen all diejenigen, die beim Geburtsjahr Schwein gehabt haben. Wenn es an ihrer Kleidung irgendwo rot aufblitzt, dann wissen alle, dass sie zum Geheimbund der Glücklichen gehören.

Nur die Schweine haben nichts von ihrem guten Ruf. Naja, in Taiwan haben Bauern diesmal eine Schweinehochzeit veranstaltet. Das Pärchen war in Schleier und Anzug gekleidet und der Eber Shui Fu-ko durfte seine wunderschöne, rosarote Braut Huang Pu-pu küssen. Aber das Jahr der Ratte, das am 7. Februar 2008 beginnt, werden sie nicht erleben. Es sei denn, als Portionen beim nächsten Neujahrsmahl. Pech gehabt, die armen Schweine.

Monday, February 12, 2007

中国将延长30公里高速列车轨道

China will Transrapid-Strecke um 30 Kilometer verlängern

12.02.2007

Auftragsabschluss für Siemens und ThyssenKrupp so gut wie sicher

Neben dem Bau einer Teststrecke zur Entwicklung einer eigenen Magnetschnellbahn-Technologie hat sich China dazu entschlossen, die Transrapid-Strecke in Shanghai um gut 30 Kilometer zu verlängern. Wie die Online-Ausgabe des Wirtschaftsmagazins 'Capital' aus Kreisen der Shanghaier Stadtregierung erfuhr, soll die zusätzliche Trasse die bereits existierende Transrapid-Strecke beim internationalen Shanghaier Flughafen Pudong mit dem Finanzzentrum auf der Ostseite des Huangpu-Flusses und dem vor allem für Inlandsflüge benutzten Flughafen Hongqiao im Westen der Stadt verbinden.

Darauf haben sich laut 'Capital' das deutsche Transrapid-Konsortium aus ThyssenKrupp und Siemens und die Shanghai Maglev Transportation Development Co. Ltd., ein Tochterunternehmen der Shanghaier Stadtregierung, nach jahrelangen Verhandlungen geeinigt. Derzeit warten die Vertragspartner darauf, dass die Pekinger Zentralregierung den Bau genehmigt. Die endgültige Entscheidung soll noch vor dem chinesischen Neujahrsfest am 17. Februar bei einer Sitzung des Staatsrats fallen.

Für Siemens-Chef Klaus Kleinfeld wäre dies ein willkommener Image-Erfolg, auch wenn das Projekt für den Konzern wirtschaftlich relativ wenig Gewicht hat. Insgesamt beträgt das Auftragsvolumen für diesen zweiten Abschnitt etwa 1,2 Milliarden US-Dollar. Das entspricht etwa den Baukosten für die existierende Strecke. Trotzdem mussten Siemens und ThyssenKrupp nach 'Capital'-Informationen große Nachlässe geben, um im Geschäft zu bleiben. Denn die Baukosten für die Trasse sind etwa doppelt so hoch wie für die erste, weil neben dem Tunnel drei zusätzliche Stationen gebaut werden müssen und die Trasse durch die Innenstadt verläuft. Außerdem sind die Preise etwa für Stahl seit dem Bau der ersten Strecke vor fünf Jahren deutlich gestiegen.

Um die Preisanforderungen der Chinesen zu erfüllen, musste das Konsortium zustimmen, dass die zunächst 30 Zugsektionen ohne Schwebetechnik komplett in zwei chinesischen Fabriken gebaut werden. Die chinesischen Arbeiter werden in Deutschland angelernt. Nur etwa die Hälfte der Siemens-Leittechnik und die Schwebe-Kerntechnologie kommen noch aus Deutschland, lauten die 'Capital'-Informationen. Immerhin konnte sich China nicht mit seiner Bedingung durchsetzen, die gesamte Technologie übertragen zu bekommen. Die Chinesen erhalten auch die in Deutschland neu entwickelte Fahrzeugreihe 09 nicht.

Die Strecke soll spätestens bis zur Weltausstellung 2010 fertig gestellt sein. Selbst unter chinesischen Fachleuten gilt diese Planung als sehr knapp. Zwar ist es gut möglich, dass der Shanghaier Transrapid in einer weiteren Bauphase um einen dritten Abschnitt in die 175 Kilometer entfernte Sieben-Millionen-Stadt Hangzhou verlängert wird. Doch von den ursprünglichen Zielen ist das Konsortium weit entfernt. Ende der 90er Jahre waren Siemens und ThyssenKrupp angetreten, erst Shanghai und Peking mit einer Trasse von 1.200 Kilometern zu verbinden und dann das ganze Land zu vernetzen.

Web-enabled Logistics: The Road to Best-in-class Shipping Management

Web-enabled Logistics: The Road to Best-in-class Shipping Management

Today's frantic pace of globalization, fueled by rampant outsourcing, has created unprecedented complexity within the logistics process and spiraling transportation costs. A top challenge for best-in-class enterprises is taking back control of the logistics process. Firms are under tremendous pressure to create real-time logistics visibility within their organizations by closing the information gap between manufacturing and the rest of the enterprise and this pressure is increasing daily as the global business day becomes ever more frenetic. To retain their competitive edge in a global market, best-in-class enterprises are adopting new technologies that bring logistics operations in line with the rest of the company's operations to simplify delivery processes and create efficiencies that can deliver real cost savings.

Global Logistics Challenges

Historically, the field of global logistics has not benefited from long-term study or research due in large part to its nature of constant motion. Lack of formal training in the profession has exacerbated its inherent challenges. In recognition of how complex the logistics field has become, the Massachusetts Institute of Technology recently introduced a new Masters degree dedicated to logistics in the school of engineering. But those currently on the logistics battlefield have been fighting on the front lines without the benefit of formal tools they can use to handle today's complex delivery challenges.

Challenge 1: Offshoring and Outsourcing Increase Delivery Costs

With ongoing market pressure for the rapid development and deployment of goods, many companies have moved their manufacturing overseas to save costs on materials. For some best-in-class enterprises, offshore sourcing has gone from 5 percent to almost 50 percent of their materials' spend. Despite the cost-reduction gains from sourcing materials offshore, companies lacking real-time visibility across their logistics operations, together with the ability to optimize international transportation costs, can inadvertently grossly underestimate total landed costs. In addition to transportation fees, enterprises face import duties, taxes, fees, carrying costs, quality costs, supply risk and safety stock as other direct cost factors — costs that can add up to 50 percent, or more, of COGS (cost of goods sold).

Challenge 2: Globalization Impacts Shipping Lanes and Costs

Currently, there is an enormous imbalance between East-West trade. As China's trade activity has increased around the globe, the westbound shipping lanes to the United States have become congested, driving up logistics costs. On the other hand, eastbound delivery routes have been severely discounted so that empty containers can be returned to the Far East. As the world's trade activities proliferate, trade lane changes, which directly drive transportation costs, will continue to impact logistics costs.

To compound the challenge, import regulations, with their extensive use of exceptions and "provisional" rules, as well as the application of non-linear tariff formulas, make it difficult to predict logistics costs. This adds a level of complexity that makes cost certainty in these areas difficult to predict over any length of time — with actual costs often not known until the actual billing has been received.

Fluctuating trade imbalances — not only with China but all around the world — have prompted best-in-class enterprises to look for a technology solution that can provide visibility and control for wildly changeable logistics costs.

Challenge 3: Absence of Centralized Cross-Carrier Logistics Information Impedes Visibility

Many of today's logistics processes are handled manually; logistics data for freight shipments do not flow into the other operational systems of most firms, thus undermining the ability to identify trends, forecast costs or get an overview of delivery activity. Invoices, reports and miscellaneous logistics paperwork come in different formats: static PDF files, sparsely populated Excel spreadsheets, illegible receipts and more. Without data that can be easily reformatted into reports, most enterprises lack the visibility needed to make truly informed decisions about how to reduce transportation costs.

Challenge 4: Limited Resources Means Relying on 3PLs

Another challenge faced by logistics departments is dwindling staff. Because many enterprises underestimate the level of logistics sophistication that their globalization efforts demand, they downsize the one department that needs more resources — not less. Some enterprises have turned to third-party logistics (3PL) companies for help. Unfortunately, the core competency of 3PLs is to expedite traffic, not necessarily to reduce a company's transportation costs.

Challenge 5: Escalating Fuel Costs Increase Transportation Fees

Rising energy costs result in higher transportation fees for trucks, ships, trains and planes. Since enterprises cannot alter the limited supply of fuel in the world, they're turning to technology to help them mitigate other components of their logistics cost equation.

Globalization adds import duties, taxes, fees, carrying costs, quality costs, supply risks and safety stock that must be factored into logistics costs.

Market Conditions

Three primary forces had to converge to provide best-in-class enterprises a cost-effective, practical solution to their logistics' problems: 1) a secure, ubiquitous World Wide Web with a fast connection, allowing easy access to real-time information; 2) the ability to organize that data into a format that assists managers to make intelligent, well-informed decisions; and 3) technology advances to support permission-based access to a global user community.

Ubiquity of the Internet

Ten years ago, when the Internet was still an unproven entity, it was viewed skeptically by enterprises. Since then, dramatic improvements in firewalls, IP protocols and load-balancing tools have made the Internet more secure, reliable and scalable. Browsers are now an accepted application user interface. And high-speed access has accelerated the adoption of the Internet as a practical day-to-day business tool. Today, enterprise employees use Explorer, Netscape, Safari and other browsers to quickly search for information, buy goods and even pay bills.

Emergence of Web-based technologies

The declining costs of bandwidth have made it possible for complex technologies to be delivered over the Web. These technologies are being developed and deployed by application service providers (ASPs). Enterprises that used to invest costly resources to develop their own applications or buy off-the-shelf software solutions now subscribe to hosted applications for a fraction of the cost of older technologies.

The ASP revolution made it possible to deliver information-rich, price-comparison engines over standard Internet browsers and — this is the important benefit — start making sense of the information. One of the more effective products of this revolution was the real-time reverse auction. Overnight, anyone with an Internet connection could find product information and compare apples-to-apples costs for travel on Expedia and Travelocity or hunt for bargains on eBay. Information that had previously been held hostage by a select few was now available to everyone online. In a free information society, competition abounds.

The Next Step: SaaS

Software-as-a-Service, or SaaS, is the next evolutionary step of the ASP model. Cutter Consortium, an Arlington, Mass., research firm, states that the transformation of the software business model from packaged products — like off-the-shelf solutions — to Web-enabled subscription services like SaaS is one of the most significant present-day trends in the IT industry because of all the benefits they offer enterprises:

- Low overhead and involvement

- Little need for IT manpower

- Immediate return on investment (ROI)

- Guaranteed cutting-edge technology

SaaS applications provide support for multiple users, multiple applications and multiple platforms. Since they run on the Web, enterprise employees can use them on any computer with Internet access. The SaaS provider takes care of all updates and maintenance to the system; the enterprise is off the hook for IT support. In today's rapidly changing world, updates can be made at a moment's notice at no additional cost to users.

Indeed, best-in-class enterprises have found that using Web-based technologies can shorten their deployment times and minimize total cost of ownership (TCO) by eliminating the upfront costs of hardware, consulting support and network setup. In fact, the Gartner Group claims that application outsourcing can actually reduce TCO by 30 to 50 percent, depending on the complexity of the application.

Business Applications

Consumer applications have paved the way, but sophisticated B2B (business-to-business) applications are now becoming commonplace in the global economy. For example, Salesforce.com is being used for enterprises as large as Cisco Systems. The pharmaceutical industry has also been using the ASP model to advantage. McKesson, one of the nation's largest pharmaceutical distributors, now allows hospital and retail pharmacies to search for and order products with real-time pricing and availability data. Not only is this process saving time, money and effort, it helps deliver the right medication to the right patient every time.

Three primary forces had to converge to provide Best-in-class enterprises a cost-effective, practical solution to their logistics' problems: 1) a secure, ubiquitous World Wide Web with a fast connection, which allowed easy access to real-world information; 2) the ability to organize that data into a format that helped managers make intelligent, well-informed decisions; and 3) technology advances that supported permission-based access to a global user community.

Case Study: Maxim Integrated Products

Maxim Integrated Products is a multi-national leader in the design, development and manufacture of integrated circuits. The company boasts 2005 net revenues of more than $1.6 billion and over 8,000 employees across facilities in the United States, the Philippines and Thailand. Diverse geographic locations made it challenging for Maxim to control shipping and distribution. Like many best-in-class enterprises, Maxim needed help with the following:

- Centralizing decision-making for how goods would be shipped and which carriers would be used

- Enforcing strict parameters on shipping methods and vendor selection

- Reducing overall costs of shipping and distribution

- Simplifying management of volumes of weekly invoices from multiple vendors

Maxim chose to adopt a SaaS shipping and freight management solution from Agistix instead of developing proprietary software. Within hours of implementation, Maxim was able to enforce a uniform policy for shipping methods and vendor selection. Gradually, Maxim realized increased pricing visibility for small-parcel shipments and began using the spot-quote market for heavy freight. By the end of one quarter after implementing the Agistix on-demand solution, Maxim had reduced shipping costs by more than 28 percent.

Within six months, instead of processing up to 500 shipping invoices each week, Maxim began receiving a single electronic invoice for all weekly transactions. With this change alone, this world-class enterprise reduced accounts payable processing time from 70 hours per week to five minutes per week, generating savings of up to $20,000 each month.

Conclusion

Best-in-class logistics processes are now available to any enterprise. Global companies know that the operational complexities caused by globalization must be managed proactively. They realize that to remain competitive in a global environment, they must optimize their supply lines to build in more flexibility and efficiencies. The road to flexibility and efficiency is technology; in particular, technologies that unite multiple processes and systems into a common information and real-time decision support network that supports all internal and external relationships.

About the Author: Frank Cirimele is a recognized expert on global trade and the practical application of effective Global Logistics Strategies. He has represented the United States on the United Nations International Trade Procedures Working Group (UN/CEFACT ITPWG), which addresses Trade Facilitation and global e-commerce issues. This respected UN group provides strategic and functional guidance to government and business entities on maximizing the efficiencies of an automated trade and logistics environment. Frank was also selected as a private sector expert by the U.S. Department of Commerce, International Trade Administration to join the Free Trade Area of the Americas (FTAA) Committee on Electronic Commerce. www.agistix.com.

Defence Logistics Has Become A Huge And Complex Market

Defence Logistics Has Become A Huge And Complex Market

| It provides a road map to this complex and fast-changing market. | ||||

| By Bharat Book Bureau -via PRLog.Org Feb 12, 2007 04:00:56 | ||||

The market for logistics services in the defence sector is huge, but at the same time it is also highly specialised. Unlike many other sectors, third party logistics providers play only a small part in a market which is dominated by the 'Systems Integrators', that is, the big weapons' manufacturers.

The market has seen fundamental changes over recent years. Previously the supply organisations of armies, navies and air forces were largely concerned with the storage and transport of ammunition, fuel and food. These concerns are still great but with manning levels in armies shrinking and the forces becoming dominated by vastly capable automated weaponry, the focus of armed forces logistics activities has shifted.

What is emerging is an emphasis on the delivery of 'capability' rather than the delivery of spares. The responsibility of maintaining a whole weapon system is moving from the armed forces towards the weapons' manufacturer. The advanced programmes propose looking towards the 'systems integrators' to handle almost all of the maintenance and logistics activities; handing over the aircraft to the air force only when it has to fly.

The impact which these ideas are having on systems' integrators is substantial. Logistics has become a central aspect of their 'offer to the market' even though these companies still view themselves as engineering specialists.

What information does European Defence Logistics 2007 contain?

Weapons systems, such as those developed by BAe, have become increasingly sophisticated.

European Defence Logistics 2007 provides a road map to this complex and fast-changing market. The report offers an ideal introduction to the opportunities which this sector presents to a wide range of different players: IT providers, contract logistics companies, freight forwarders, road and rail contractors, air cargo and shipping operators. Its in-depth examination of the sector is essential reading for defence logistics staff, consultants and analysts.

European Defence Logistics 2007 contains sections on:

- The logistics requirements, strategies and policies of the three main European

- Defence Departments: United Kingdom, France and Germany.

- The IT systems presently employed and their functionality.

- Analysis and overview of the key European systems’ integrators: Rolls Royce, Thales, Agusta Westland, BAe and EADS.

- The developing role of the third party logistics sector in the market and the key players.

- An analysis of the use of logistics in the recent Iraq War, examining its success and failures.

The report also contains a section on the logistics employed by the British Army during the Iraq War, critiquing its effectiveness and the repercussions it has had, both operationally and politically.

Insight into Defence Logistics

Source: Hungarian ITD European Defence Logistics 2007 will provide you with an insight into how the logistics strategies of the major Defence Departments have changed over the last two decades—from a focus on manpower to technologically sophisticated weapons systems with highly complex logistics requirements. The role of the private sector in maintaining these systems, once unthinkable, is now commonplace and private contractors can even be found on the front line.

However, despite being partners in NATO, the strategies of the three largest spenders in Europe: UK, France and Germany are very different. European Defence Logistics 2007 explains how they diverge and what the future for the sector holds.

Weapons Systems Manufacturers

The most important players in European Defence supply chains are the major weapons systems manufacturers: a relatively small number of high tech multinational conglomerates. Although they still see their core competency as engineering, they are increasingly involved in after sales logistics, ensuring maximum up-time for their products in what can be extreme and hostile environments.

Logistics supply side

Southern Iraq - Key Logistics Bases Logistics companies play an important role in the warehousing and transportation of equipment, product and parts in defence supply chains. As an increasing level of business is out-sourced by Defence Departments, there exist substantial opportunities for their further involvement in the sector. European Defence Logistics 2007 looks at the operations and involvement of the major European carriers, freight forwarders and contract logistics players as they seek to extend their influence in this sector.

Also included in the report is an in-depth look at the recent Iraq War and a critique of the success of the massive logistics operation involved.

Saturday, February 10, 2007

物流策略:构建物流模型

| ||||||

Monday, January 29, 2007

首家提供无碳运输服务的物流公司

First logistics company to offer carbon neutral delivery service

DHL and the World Economic Forum (WEF) tannounced that DHL’s new carbon neutral shipping service GOGREEN will help the World Economic Forum to realize its Carbon Neutral promise for Davos.

DHL GOGREEN is a value-added service that offsets the CO2 emissions caused by the transportation with carbon dioxide reduction projects ranging from alternative vehicle technologies to renewable fuels. The service was launched given the urgency of the fight against climate change, which is a key subject of the Forum´s crucial and prestigious Annual Meeting that brings together world leaders, shaping global, regional and industry agendas.

All participants at the Annual Meeting in Davos will be provided with the opportunity to ship event materials without causing CO2 emissions by using GOGREEN. Additionally, two DHL Express Switzerland carbon-neutral biogas-powered vehicles will be on hand, providing prompt pickup and delivery services.

- Environmental responsibility is an integral part of living up to our corporate values and we see an increasing number of our global business customers seeking ways to reduce their environmental impact. With DHL GOGREEN, we offer an international solution for European customers, making carbon-neutral shipping easy” says Ad Ebus, CEO DHL Express Europe.

For sending carbon-neutral shipments, the customer only has to choose the service when ordering international express shipments; DHL takes care of the rest. The carbon reduction projects portfolio is handled through a certified corporate carbon management program, facilitating the carbon exchange between business units and projects. To ensure accountability and transparency, the program is annually verified by the external certifying body, the Swiss based SGS.

- We are delighted to be using DHL’s GOGREEN service for our Annual Meeting. With climate change on the top of the World Economic Forum´s agenda and coupled with the effort to make our Annual Meeting carbon neutral with the Davos Climate Alliance, DHL’s GOGREEN service is an obvious choice for us”, says André Schneider, Managing Director and COO of the World Economic Forum.

Av John Smith

-->

Sist oppdatert: 28.01.07 11:21

Friday, January 26, 2007

Supply Chain Integration: Crossing the Marketing and Logistics Divide

Overcoming the Barriers to Improved Internal Collaboration

SCDigest Editorial Staff

The News: Research in the Journal of Business Logistics identifies key barriers to better internal collaboration between marketing and logistics functions

The Impact: The prescriptions to improve collaboration are not new, but a fresh reminder of the opportunities to better integrate these functions internally is worth considering.

The Story: Many people may not know or remember, but to a large extent logistics as a discipline grew out of the field of marketing, where “distribution” was considered a sub-discipline.

In the fall 2006 issue of the Journal of Business Logistics (available to members of the Council of Supply Chain Management Professionals at its web site: www.cscmp.org) Alexander Ellinger and John Hansen, of The University of Alabama, and Scott Keller, from The University of West Florida, published research based on a number of in-depth interviews they did with both logistics and marketing professionals in business-to-business oriented corporations.

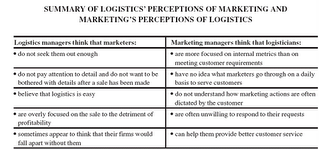

To the surprise of no one with experience in either area, to a large extent logisticians and marketers think the other side is less than cooperative and focused correctly. A summary of the perspectives of each side is included by the authors, and published below:

Source: Journal Of Business Logistics, Vol. 27 - No. 2

Again, it will not come as a surprise that the authors found that “Logistics managers in our sample were frustrated by the relative indifference towards the logistics function and lack of attention to detail of their marketing colleagues. Logistician respondents stated that they frequently find themselves having to react to fulfill marketers’ promises to customers that have been made without input from logistics.”

They quote one respondent as saying, “Marketing people, in my opinion, will not come to logistics people. As a logistics person, the burden of proof is on me to go to them.”

On the other hand, as the authors write, “A common perception among the marketing manager respondents was that logistics is often willing to forsake the customer to save on costs.”

One interviewee on the marketing side commented: “You always get the feeling when you talk to [logistics] people that they’re too busy.” Does that ring home at all?

The authors identified a number of barriers to improved collaboration between sales and marketing. These are summarized below:

Source: Journal Of Business Logistics, Vol. 27 - No. 2

The approaches to overcoming these barriers should be fairly obvious. In the end, it’s all about leadership, communication, and listening first, talking second.

Certainly, many consumer goods companies, such as Campbell’s Soup and a number of others, that have very successfully implemented customer logistics teams that integrate sales, marketing and logistics, understand these opportunities very well.

What’s your take on the integration of marketing and logistics? Is it better than in the past? Why or why not? How do you think it the collaboration can best be improved?

Wednesday, January 24, 2007

DHL包揽Wyeth药业物流业务合同

24/01/2007 - Shipping giant DHL has bagged a lucrative contract with pharma giant Wyeth and become the first logistics provider to be given complete responsibility for a company’s worldwide clinical trial materials distribution.

It is no surprise that Wyeth is the first pharma company to make such a move. The company is a huge proponent of outsourcing in order to stay competitive and its business model is now based around the principle of outsourcing or off-shoring anything that is not a core function.

According to DHL, Wyeth is hoping the new arrangement will increase efficiencies within its clinical trial materials distribution process by “uniting the flow of information and physical goods through automation and improved collaboration.”

It will also enable each step of medical material transfer to be visible and monitored from product development to trial to consumption, providing Wyeth with improved visibility and control of its clinical shipments, said DHL.

Under the deal, the terms and length of which were not disclosed, DHL will oversee and co-ordinate the logistics of Wyeth's clinical material shipments and processes throughout multiple distribution channels across the globe, as well as the warehousing of materials.

Together, Wyeth and DHL will create a closed-loop clinical trial materials supply chain to streamline track and trace capabilities, financial and performance indicators and operational process flows.

Commenting on the arrangement, Ira Spector, vice chief of operations in clinical development at Wyeth Research said: "We believe this unique collaboration has the potential to reduce the logistical complexity of our clinical trial operations by providing a leading global infrastructure, and expertise in logistics solutions within the life science industry."

"Our goal is for DHL to significantly streamline our clinical trials logistics operations, improve our clinical trial logistical analysis and rationalisation of related warehouse optimisation, and encompass services provided to our research organisation and third party service providers."

Tuesday, January 23, 2007

什么是射频识别?

射频识别即RFID(Radio Frequency IDentification)技术,又称电子标签、无线射频识别,是一种通信技术,可通过无线电讯号识别特定目标并读写相关数据,而无需识别系统与特定目标之间建立机械或光学接触。

Radio Frequency Identification (RFID) is an automatic identification method, relying on storing and remotely retrieving data using devices called RFID tags or transponders. An RFID tag is an object that can be attached to or incorporated into a product, animal, or person for the purpose of identification using radio waves. Chip-based RFID tags contain silicon chips and antennae. Passive tags require no internal power source, whereas active tags require a power source.

RFID标签的类别

Types of RFID tags

RFID标签分为被动,半主动(也称作半被动),主动三类。

RFID cards are also known as "proximity", "proxy" or "contactless cards" and come in three general varieties: passive, semi-passive (also known as semi-active), or active.

被动式(Passive)

被动式标签没有内部供电电源。其内部集成电路通过接收到的电磁波进行驱动,这些电磁波是由RFID阅读器发出的。当标签接收到足够的信号时,可以向阅读器发出数据。这些数据不仅包括ID号(全球唯一标示ID),还可以包括预先存在于标签内EEPROM中的数据。

由于被动式标签具有价格低廉,无需电源的优点。目前市场的RFID标签主要是被动式的.

半主动式(Semi-Active)

一般而言,被动式标签的天线有两个任务,第一:接收阅读器所发出的电磁波,藉以驱动标签IC;第二:标签回传信号时,需要靠天线的阻抗作切换,才能产生0与1的变化。问题是,想要有最好的回传效率的话,天线阻抗必须设计在“开路与短路”,这样又会使信号完全反射,无法被标签IC接收,半主动式标签就是为了解决这样的问题。半主动式类似于被动式,不过它多了一个小型电池,电力恰好可以驱动标签IC,使得IC处于工作的状态。这样的好处在于,天线可以不用管接收电磁波的任务,充分作为回传信号之用。比起被动式,半主动式有更快的反应速度,更好的效率。

主动式(Active)

射频识别技术包括了一整套信息技术基础设施,包括:

* 射频识别标签,又称射频标签、电子标签,主要由存有识别代码的大规模集成线路芯片和收发天线构成,目前主要为无源式,使用时的电能取自天线接收到的无线电波能量;

* 射频识别读写设备以及

* 与相应的信息服务系统,如进存销系统的联网等。

将射频类别技术与条码(Barcode)技术相互比较,射频类别拥有许多优点,如:

* 可容纳较多容量。

* 通讯距离长。

* 难以复制。

* 对环境变化有较高的忍受能力。

* 可同时读取多个标签。

相对地有缺点,就是建置成本较高。不过目前透过该技术的大量使用,生产成本就可大幅降低。

技术及性能参数

射频识别标签是目前射频识别技术的关键。射频识别标签可存储一定容量的信息并具一定的信息处理功能,读写设备可通过无线电讯号以一定的数据传输率与标签交换信息,作用距离可根据采用的技术从若干厘米到1千米不等。

识别标签的外形尺寸主要由天线决定,而天线又取决于工作频率和对作用距离的要求。目前有四种频率的标签在使用中比较常见。他们是按照他们的无线电频率划分:低频标签(125或134.2千赫),高频标签(13.56兆赫),超高频标签(868到956兆赫)以及微波标签(2.45GHz)。由于目前尚未制定出针对超高频标签使用的全球规范,所以此类标签还不能够在全球统一使用。而超高频标签的应用目前也最受人们的最受注意,此类标签主要应用在物流领域。频率越高,作用距离就越大,数据传输率也就越高,识别标签的外形尺寸就可以做得更小,但成本也就越高。目前面向消费者的识别标签外形尺寸需求,一般以信用卡或商品条形码为准。

2005年初每标签的价格仍在30欧分左右,大批量(十亿个以上)生产的射频识别标签的价格可望在2008年降至10欧分以下。

鉴于标签和读写设备之间无需建立机械或光学接触,密码技术在整个射频识别技术领域中的地位必将日益提高。随着射频识别的普及,不同厂家的标签和读写设备之间的兼容性也将成为值得关注的问题。

此外,使用寿命、使用环境和可靠性也是重要参数。

Current uses:

Passports,

Transport payments,

Product Tracking,

Automotive,

Animal identification,

RFID in inventory systems,

RFID mandates,

Human implants.

Security concerns

A primary security concern surrounding RFID technology is the illicit tracking of RFID tags. Tags which are world-readable pose a risk to both personal location privacy and corporate/military security. Such concerns have been raised with respect to the United States Department of Defense's recent adoption of RFID tags for supply chain management. More generally, privacy organizations have expressed concerns in the context of ongoing efforts to embed electronic product code (EPC) RFID tags in consumer products.

A second class of defense uses cryptography to prevent tag cloning. Some tags use a form of "rolling code" scheme, wherein the tag identifier information changes after each scan, thus reducing the usefulness of observed responses. More sophisticated devices engage in challenge-response protocols where the tag interacts with the reader. In these protocols, secret tag information is never sent over the insecure communication channel between tag and reader. Rather, the reader issues a challenge to the tag, which responds with a result computed using a cryptographic circuit keyed with some secret value. Such protocols may be based on symmetric or public key cryptography. Cryptographically-enabled tags typically have dramatically higher cost and power requirements than simpler equivalents, and as a result, deployment of these tags is much more limited. This cost/power limitation has led some manufacturers to implement cryptographic tags using substantially weakened, or proprietary encryption schemes, which do not necessarily resist sophisticated attack. For example, the Exxon-Mobil Speedpass uses a cryptographically-enabled tag manufactured by Texas Instruments, called the Digital Signature Transponder (DST), which incorporates a weak, proprietary encryption scheme to perform a challenge-response protocol.

Still other cryptographic protocols attempt to achieve privacy against unauthorized readers, though these protocols are largely in the research stage. One major challenge in securing RFID tags is a shortage of computational resources within the tag. Standard cryptographic techniques require more resources than are available in most low cost RFID devices. RSA Security has patented a prototype device that locally jams RFID signals by interrupting a standard collision avoidance protocol, allowing the user to prevent identification if desired. Various policy measures have also been proposed, such as marking RFID tagged objects with an industry standard label.

Controversy.

How would you like it if, for instance, one day you realized your underwear was reporting on your whereabouts?

— California State Senator Debra Bowen, at a 2003 hearing

The use of RFID technology has engendered considerable controversy and even product boycotts by consumer privacy advocates such as Katherine Albrecht and Liz McIntyre of CASPIAN who refer to RFID tags as "spychips". The four main privacy concerns regarding RFID are:

* The purchaser of an item will not necessarily be aware of the presence of the tag or be able to remove it

* The tag can be read at a distance without the knowledge of the individual

* If a tagged item is paid for by credit card or in conjunction with use of a loyalty card, then it would be possible to tie the unique ID of that item to the identity of the purchaser

* The EPCglobal system of tags create globally unique serial numbers for all products.

Most concerns revolve around the fact that RFID tags affixed to products remain functional even after the products have been purchased and taken home and thus can be used for surveillance and other purposes unrelated to their supply chain inventory functions. [citation needed]

Another privacy issue is due to RFID's support for a singulation (anti-collision) protocol. This is the means by which a reader enumerates all the tags responding to it without them mutually interfering. The structure of some collision-resolution (Medium Access Control) protocols is such that all but the last bit of each tag's serial number can be deduced by passively eavesdropping on just the reader's part of the protocol. Because of this, whenever the relevant types of RFID tags are near to readers, the distance at which a tag's signal can be eavesdropped is irrelevant; what counts is the distance at which the much more powerful reader can be received. Just how far this can be depends on the type of the reader, but in the extreme case some readers have a maximum power output of 4 W, enabling signals to be received from tens of kilometres away.[citation needed] However, more recent UHF tags employing the EPCglobal Gen 2 (ISO 18000-6C) protocol, which is a slotted-Aloha scheme in which the reader never transmits the tag identifying information, are not subject to this particular attack.

RFID Shielding(射频识别屏蔽)

A number of products are available on the market in the US that will allow a concerned carrier of RFID-enabled cards or passports to shield their data. Simply wrapping an RFID card in aluminum foil, essentially creating a Faraday cage, is claimed to make transmission more difficult, yet not be completely effective at preventing it.